Government of West Bengal

Transport Department

Paribahan Bhaban

12, R. N. Mukherjee Road, Kolkata – 700 001

No. 289-WT/TR/1E(C)-40/16 Date: 20.01.2017

NOTIFICATION

In a recent decision, State Government decided to allow online registration applications along with payment of fees and taxes over internet through the e-Vahan application and GRIPS respectively after integration of the two web based applications, with a view to enhance “ease of doing business” in this State. As the integration has been achieved, the State Government in the Transport Department has decided that the combined facilities will be introduced in phases beginning with the PVD, Kasba and Alipore motor vehicle offices on 31/01/2017 in a pilot mode for real time stabilisation of the integrated applications, as aforesaid, in the manner as below:

Scope: Online application with e-payment of fees and taxes for registration of motor vehicles by the concerned dealers.

Conditions: Such scope shall be subject to strict observance of the following:-

- Applicable for Non-transport vehicles like cars and two wheelers only.

- In cases of individual owners only and also in cases where the vehicle is owned by a company/ farm, etc. for vehicles having seats up to 7, (i.e. 7 i.d.)

- Documents that may be accepted as Proof of Address will be as provided for in Rule 4 of C M V Rules only. Only affidavits will not be accepted. Additional acceptable documents as proof of address may be as per this Department no 2473-WT/3M-31/2008 dtd 12/07/2012.

- No registration of vehicles will be done other than the cases mentioned above.

- No cases involving allotment of fancy number fees will be accepted and such cases will be referred to the concerned Registering Authority (RA) only.

- Concerned dealer will not deliver any vehicle without HSRP affixation.

- No registration cases should be taken up involving exemption of fees and/ or taxes and the files should be sent to the concerned RA only.

- Since e-Vahan is internet based and all concerned will be working in a single database, the authorised dealers must apply for and obtain RA-specific userid and password from the RA having jurisdiction, i.e. where they have approved showroom and valid Trade Certificates (TC). However, considering the ‘ease of doing business’ aspect, application for additional userids may be made by any dealer in the manner as below:

- a. For all offices in any district wherever they have obtained TCs in any of them, viz, a TC holder from PVD, Beltala may opt for additional userids for the offices at Kasba, Salt Lake and Behala.

- b. Such facility may be extended to a maximum of three contiguous districts as well, if so opted by any dealer, to enable them to send vehicles to those RA offices on the strength of valid TCs, viz, a TC holder of PVD Beltala will be able to register a vehicle in Alipore or Howrah, subject to strict observance of rules governing such use of TC.

- c. In all other cases they will take recourse to the temporary registration process and deliver the vehicle to the owner only after temporary registration.

- A detailed list of “Do’s and Don’ts” has been attached herewith for strict compliance by the dealers opting for online registration application with e-pay process (Annexure – A).

- Another document detailing the online work process has been attached (Annexure – B).

- A form for application for userid creation by dealers is attached herewith (Annexure – C). One week after stabilisation of the work processes, this facility will be extended to all e-Vahan enabled offices. Thereafter, e-Vahan will be rolled out in any office along with such facility only.

It may be noted that this is an option for the dealers and not mandatory for them. Violation of any condition, as aforesaid, by any dealer may attract immediate withdrawal of such facility and actions thereto against him in terms of the extant provisions of Law and related orders that have been issued. All concerned will act in strict accordance with the above.

This order is issued in the interest of public.

By order of the Governor

Sd/- B. Dasgupta

Special Secretary to the

Government of West Bengal

Annexure – A

Online registration application – Do’s and Don’ts for Dealers:

Do’s:-

- Must obtain userid/password from the RA having jurisdiction. Must ensure login with the correct userid, so that only the RA having jurisdiction over the address of the owner gets the digital file.

- In compliance of section 40 of the M V Act, 1988, registration to be done at the concerned Registering Authority in whose jurisdiction the purchaser has the residence or place of business. This shall be strictly followed.

- Registration applications for Non-transport cars and two wheelers to be handled only.

- Registration applications in the name of individuals only to be taken up.

- Registration applications in the name of a company/ farm, etc. and for vehicles having up to 7 seats including driver only, may be taken.

- To confirm that the ‘Address Proof’s that are accepted are as per Rule 4 of the C M V Rules only. No affidavits are to be entertained. Additional acceptable documents for this purpose may be as detailed in No. 2473-WT/3M-31/2008 dtd 12/07/2012.

- In case of more than one individual purchaser, the owners must select one name for the registration purpose in pursuance of section 41 of the M V Act, 1988 and the vehicle will be registered in his/ her name only.

- PAN card is mandatory. Mobile No is mandatory. Email address to be preferred.

- Prior showroom inspection is a must.

- Must ensure presentation of hardcopy of the file preferably the same day and in no case later than the next working day.

- Ensure accurate entry of actual date of sale.

- Ensure that only BS-IV compliant cars are registered in Kolkata. Ensure only BS-IV/ BS-III compliant cars are registered elsewhere.

- Ensure that only BS-III compliant two wheelers are registered in Kolkata. And only BS-III/ BS-II compliant two wheelers are registered elsewhere.

- Check that the sale value entered is the same with the one that will be declared for VAT.

Don’ts:-

- No registration application to be done in cases other than the cases mentioned above, i.e. nontransport cars and two wheelers only.

- No cases involving fancy numbers to be accepted – all such cases to be referred to RA.

- Must not deliver car without HSRP affixation.

- No cases should be taken up involving exemption of fees and/ or taxes.

Annexure-B

NEW RC ENTRY

STEP 1: Log in with your user id and password in Dealer Login Panel. URL: “parivahan.gov.in”

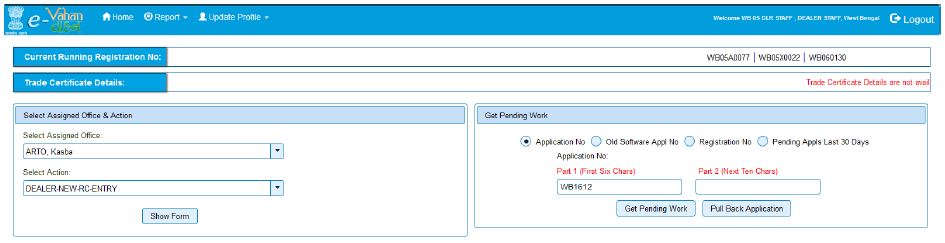

STEP 2: Select action ‘DEALER-NEW-RC-ENTRY’ and click on ‘Show Form’ button.

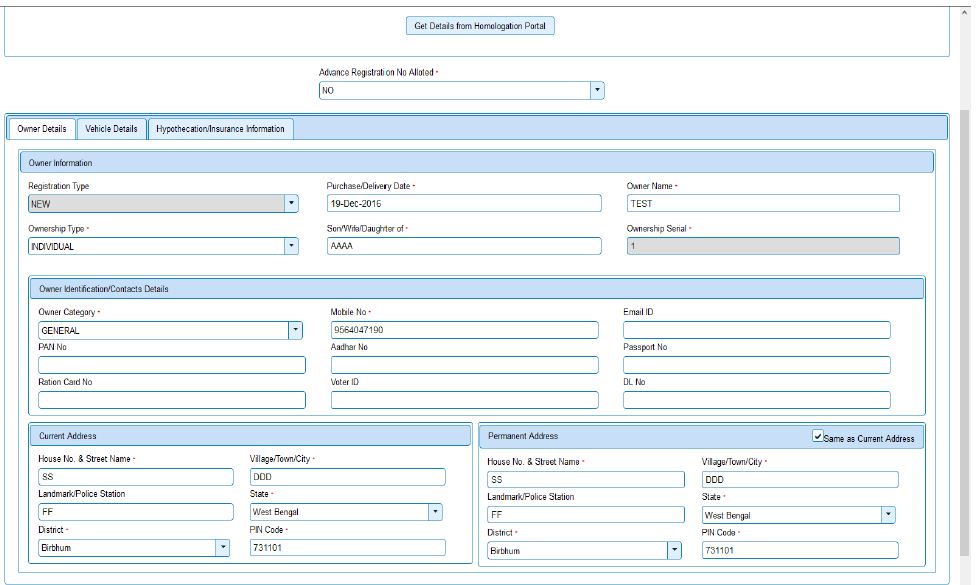

STEP 3: Enter ‘Chassis No’ and last 5 characters of ‘Engine no’ then click on ‘Get Details From Homologation Portal’ button. Fill up ‘Owner Detail’s.

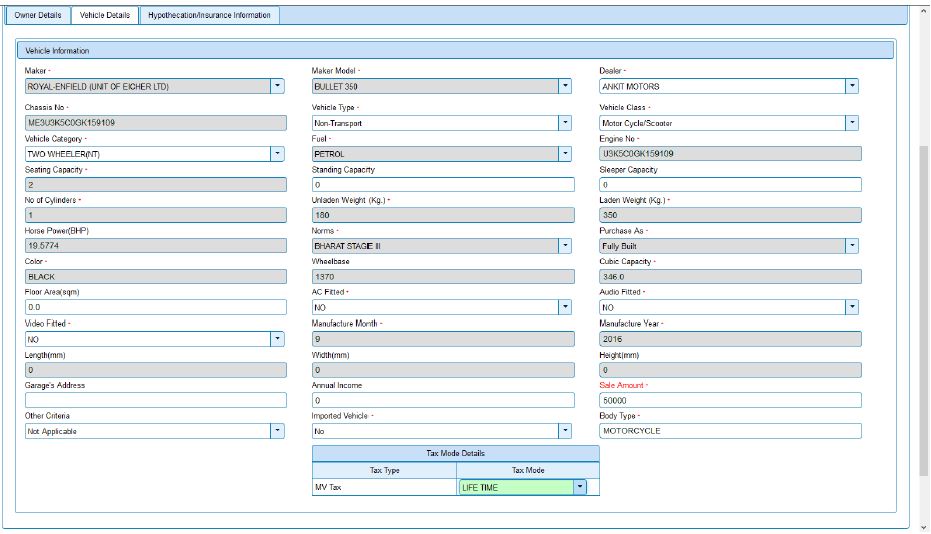

STEP 4: Some technical details of vehicle will show from Homologation portal. Fill up other Vehicle Details that are not shown.

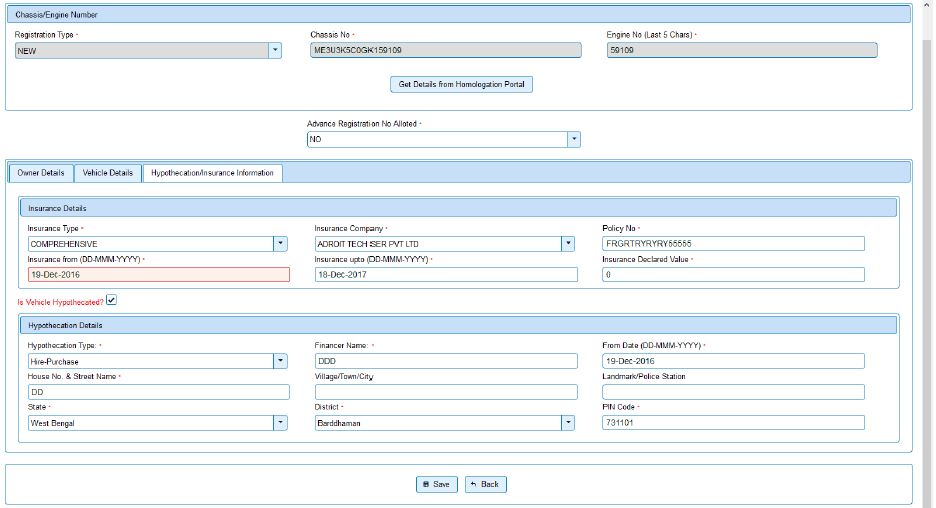

STEP 5: Fill up ‘Insurance details’. If vehicle is ‘Hypothecated’ then click on ‘checkbox’ and fill up Hypothecation details otherwise no need to click on checkbox.

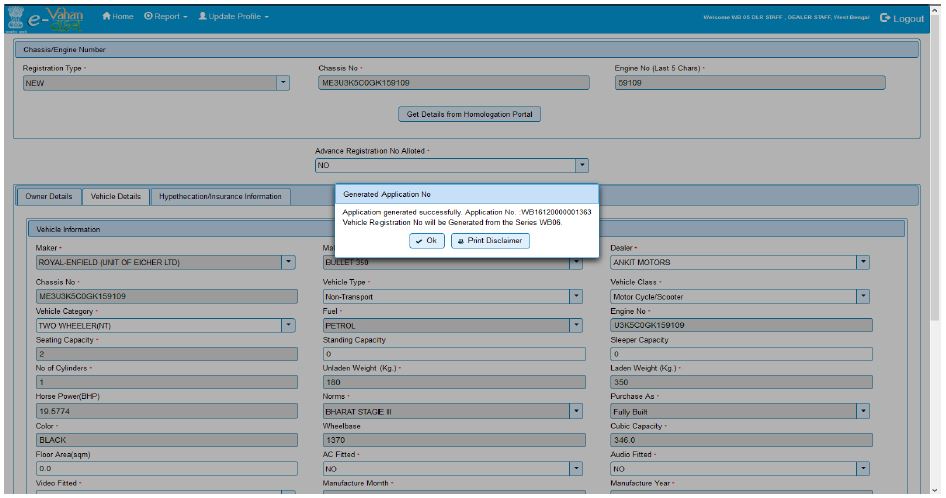

STEP 6: After filling up ‘Owner Details’, ‘Vehicle Details’, ‘Hypothecation/ Insurance Details’ click on ‘Save’ button. Then ‘Application No’ will be generated automatically. You can click on ‘Print Disclaimer’ button to take print out of this ‘disclaimer notice’ for acceptance by the owner. Otherwise click on ‘ok’ button.

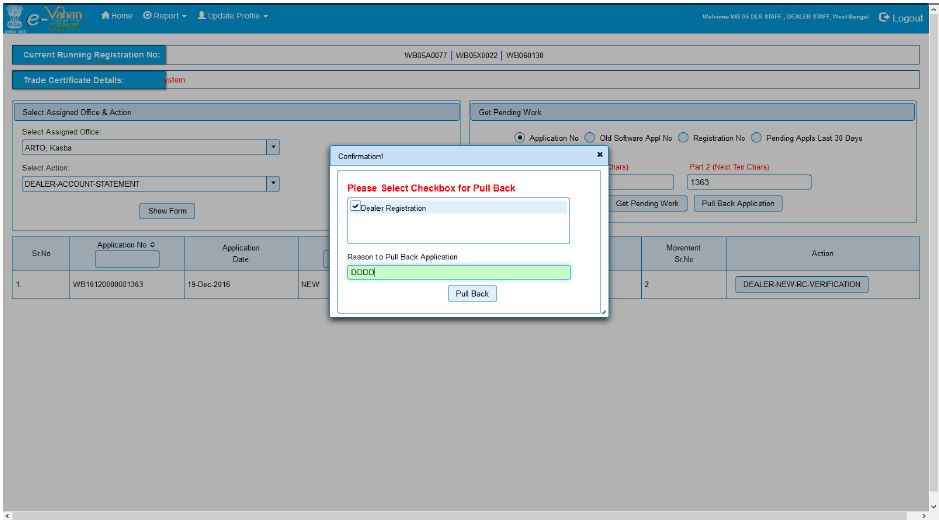

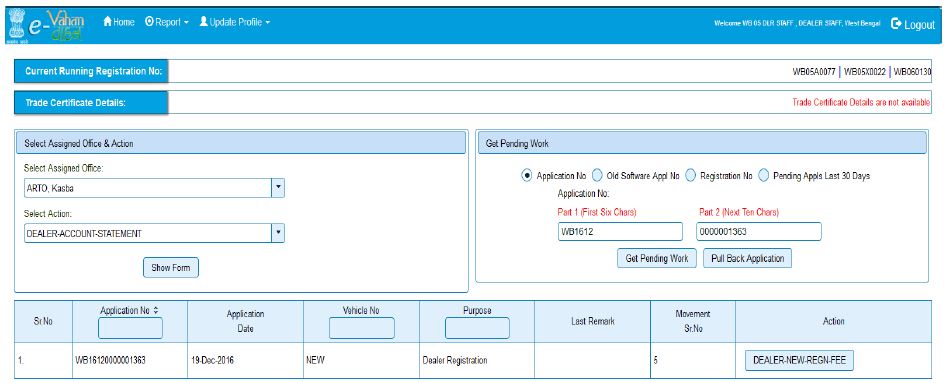

STEP 7: If wrong entry occurs, you can click on ‘Pull Back Application’ button to pull back data for rectification. If not, then click on ‘Get Pending Work’. You can click on ‘DEALER-NEW-RC-VERIFICATION’ action button to proceed to the next stage.

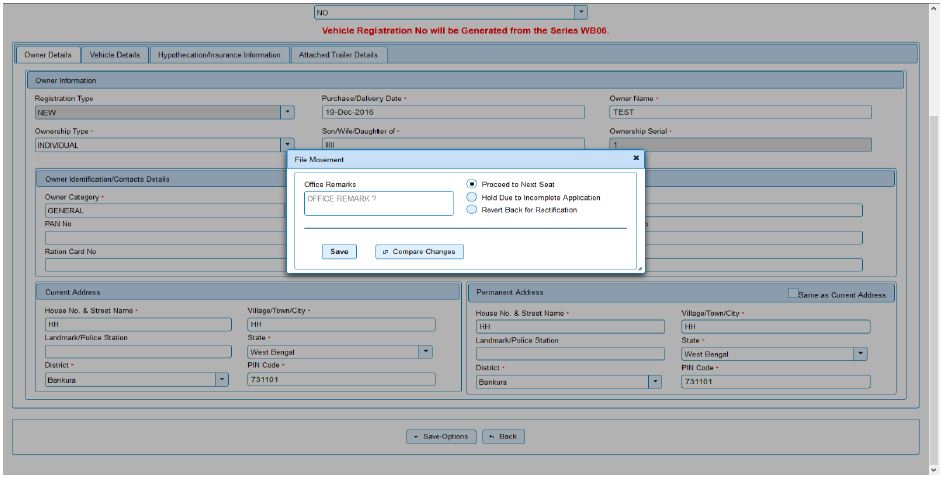

STEP 8: You can verify and modify details and click on ‘File Movement’ to proceed to the next stage.

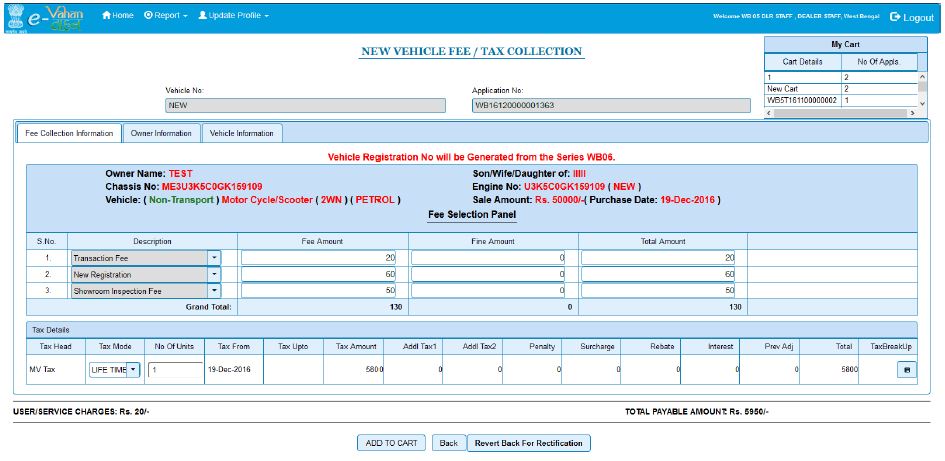

STEP 9: Click on ‘DEALER-NEW-REGN-FEE’ button to proceed to the next stage.

STEP 10: Click on ‘ADD TO CART’ button.

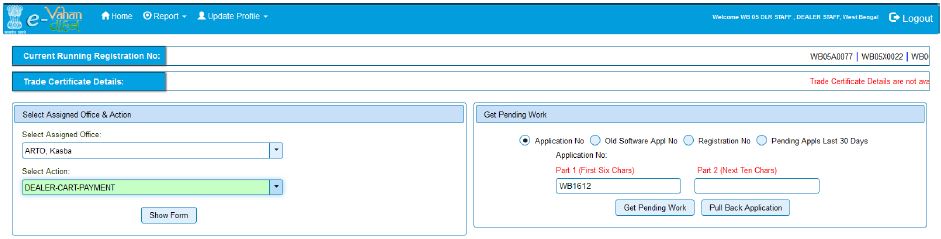

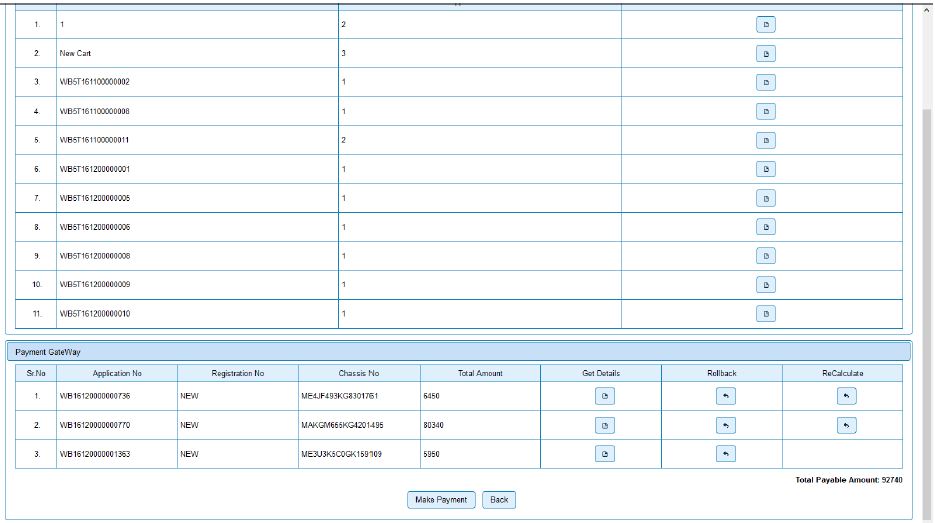

STEP 11: Select action ‘DEALER-CART-PAYMENT’ and click on’ Show Form’ button.

STEP 12: Click on ‘Get Cart Details’ button to make payment. Click on ‘Rollback’ button to revert back for rectification (If required).Click on ‘Make Payment’ button to payment for all new application.

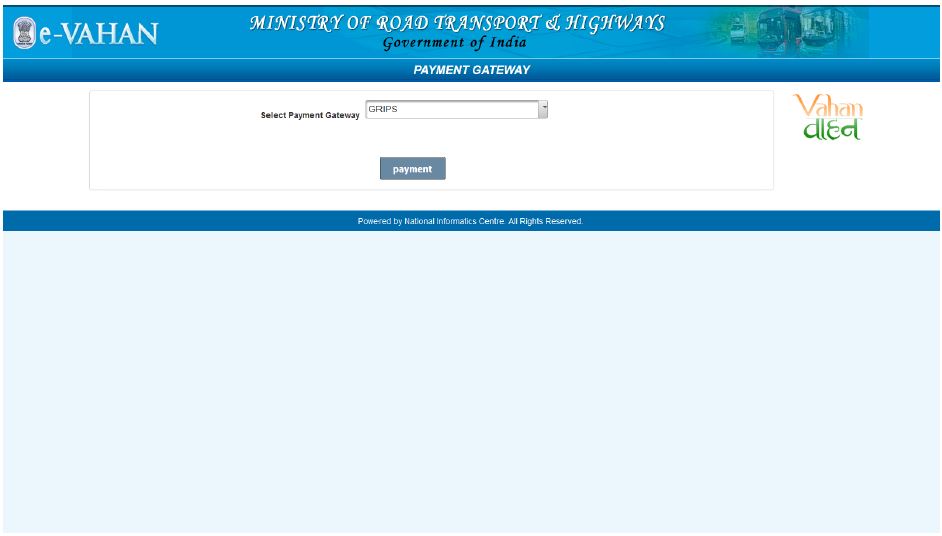

STEP 13: Select ‘Payment Gateway’ as ‘GRIPS’ and click on ‘payment’ button.

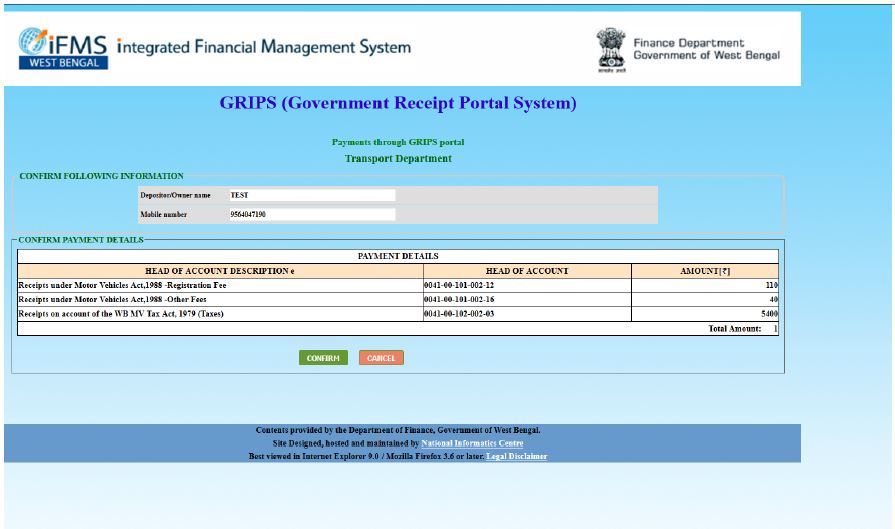

STEP 14: Click on ‘confirm’ button.

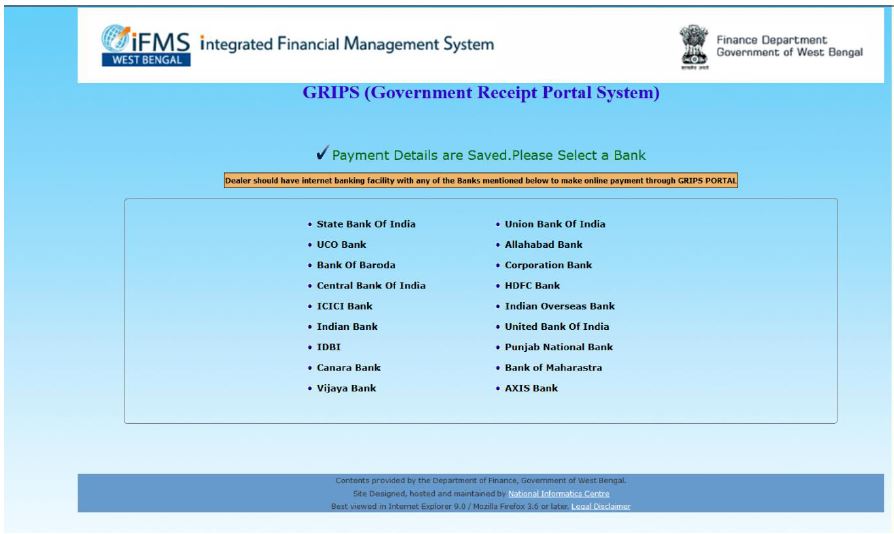

STEP 15: You should have internet banking facility with any of the Banks mentioned below to make online payment through ‘GRIPS PORTAL’. Select the concerned bank to pay online through the selected bank.

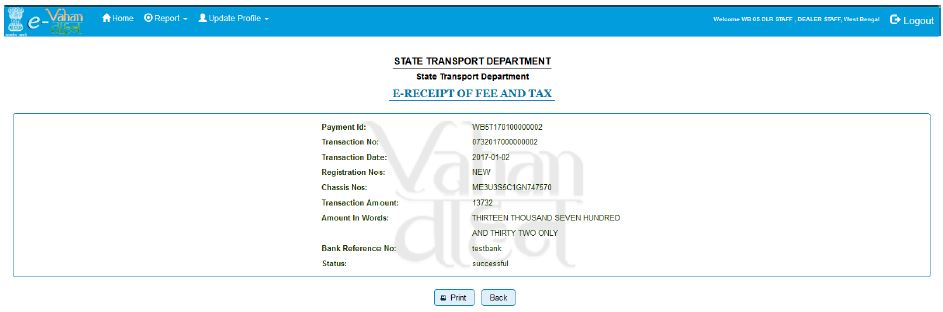

STEP 16: If payment has been done successfully. E-RECEIPT of fee and tax will display. You can take print by clicking on print button.

Anexure-C

Application Form for Login Id Creation for the Dealer Registration