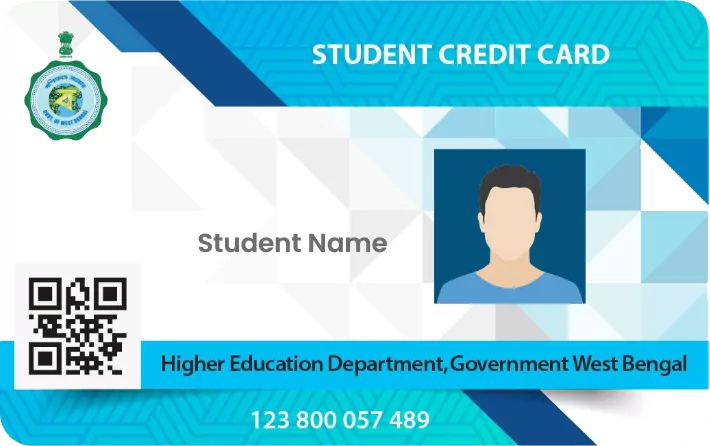

Name of the Scheme: West Bengal Student Credit Card Scheme, 2021

Beneficiary: Students residing in West Bengal above 10 years. Loan will be available for undergraduate, postgraduate, doctoral and post-doctoral study in India or abroad. Students till the age of 40 years of age are eligible for the scheme.

Objective: To provide soft loans upto Rs. 10 lakh to pursue higher studies with the help of Credit Card.

Fifteen years will be given to a student to repay the loan after getting a job.

Date of Launch: The decision to launch this scheme was taken in a state cabinet meeting which was held on 24th June 2021.

Website: https://wbscc.wb.gov.in/

Download:

- Students Credit Card Scheme Gazette Notification

- Amendment of Gazette Notification

- How to Apply for Students Credit Card in English

- How to Apply for Students Credit Card in Bengali

- How to Apply for Students Credit Card for Courses Outside India

- User Manual for 100% Document Submission

- User Manual for Institutions

- User Manual for Higher Education Department

- User Manual for Bank

Descriptive Check-List of Documents for Students under WBSCC Scheme

| Check-List of Documents | Type of Document | Where to get the document |

|---|---|---|

| Loan application on Bank’s format | As desired by individual Banks | Concerned Bank Branch |

| Proof of Address for Borrower & Co-Borrower | Aadhar Card OR Ration Card OR EPIC Card | Self |

| Proof of Age. Copy of PAN of student Borrower and Co-Borrower. In case PAN is not available at the time of sanction, the same is to be obtained before disbursement of the education loan. | Birth Certificate OR Admit Card of 10th Standard from Recognised Board OR PAN Card | Self |

| Proof of having cleared the last qualifying examination | Result/ Certificate from Recognised Board or University | Institute |

| Letter of admission | From the recognized Institution | Institute |

| Prospectus of the course wherein charges like Admission Fee, Examination Fee, Hostel Charges etc. is mentioned. | From the recognized Institution | Institute |

| Details of Assets & Liabilities of parent(s)/ co-borrower. | Sample document | Self |

| ITR of Co-Borrower for last 2 years, if filed and available. | 1. In case the Borrower/ Co-borrower have filed ITR- ITR copy 2. In case having no ITR copy need an Income certificate from Local SDO/BDO | 1. Self 2. Local SDO/ BDO |